The dynamic and innovative nature of our age makes improvement and change compulsory in every field. Countries, which attain the change and do not restrict it to numeric data; while taking the social requirements into account can manage to provide the social welfare of its citizens.

The social security system in Turkey is predominantly similar to Bismarck model, one of four basic insurance systems which are Continental Model (Bismarck), Liberalistic Model (Beveridge), Northern European Model and Mediterranean Model. Bismarck Model refers to a system where the premiums paid over the wages of employees according to their insurance status are collected in a joint pool and the benefits are provided based on the paid premiums only when old-age pension is entitled. The amount of the benefits to be granted to the insurance holders in cases of retirement, accident and sickness varies by the income they previously had. The main actors in this system are employees, employers and representatives in public sector. This system has more regulatory measures in labor market than liberalistic system, which hinders labor market flexibility. Concordantly, strict rules and collective bargaining mechanisms have come to the fore.

Turkish Social Security System has also some elements of the Mediterranean Model as well as Bismarck Model. The Mediterranean Model is derived from the Continental Model and bears a resemblance to this model in the sense that the paid social insurance premiums provide a basis for future social security benefits. Another aspect of the Mediterranean Model similar to Turkish Model is the wideness of informal economy. For this reason, the system does not cover many people; however social risks are tried to be eliminated through family ties. This model has brought into prominence the concepts of traditional family and agricultural society; thus people are supported by their families without considering whether the state provides benefits or not in case of revenue loss or social risks.

By this reform, a number of structural changes have been made on Turkish social security system. A transition has been realized from the system which entitles various rights to different professional groups to the system which ensures the unity of standards and norms in terms of retirement insurance.

Having the aim to ensure the sustainability of the system, these structural changes have not led to deviation from the Mediterranean Model-Continental Model.

Social Security Reform

Since 1990s, a number of financial problems have been experienced in Turkish social security system due to various reasons such as early retirement implementations, high rates of unregistered employment and income replacement and low rates of premium collection and earning subject to contribution. This system does not include the entire population and not have adequate safeguards against poverty. The provision of services by different social security institutions in nonsystematic way hinders the unity of norms regarding rights and obligations of employees. It became compulsory to make reforms in social security system as a result of all these problems and ageing tendency of the population which is one of the major factors affecting the financial sustainability of the system.

For the purpose of restructuring the social security system, a reform was realized in 2008 when the Law No. 5510 entered into force for seeking solutions to the prominent problems such as the existence of increasing deficit of the system and different implementations that the institutions had in the provision of health and insurance services.

The primary aim of the social security reform is to create an equitable, easily-accessible and financially sustainable social security system that provides more effective protection from poverty.

The social security reform consists of 4 complementary components:

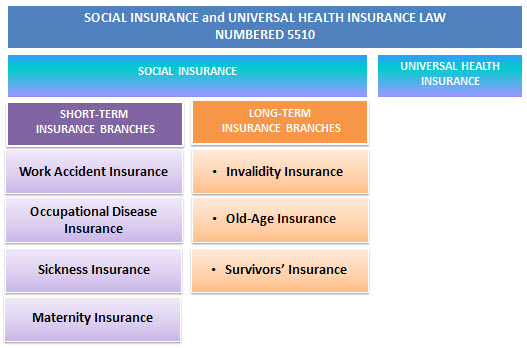

- Universal Health Insurance providing an equitable, protective and quality healthcare services for the entire population,

- An aid system which enables all needers to access the services with the combination of non-contributory payments and social benefits provided disorganizedly,

- A single retirement regime including short and long term insurance branches apart from health insurance,

- A new institutional structure facilitating daily life of our citizens through modern and efficient services.

The social security reform particularly includes the regulations regarding the enhancement of the retirement system and expenses. From this point of view, a set of changes have been made on pension replacement rate, updating coefficient, number of paid premium days and age parameters and a transition period has been envisaged. As the previous rules continue to be followed until the completion of transition period, the effect of these parametric changes on social security deficit cannot be seen exactly in the short term until the 2040s.

The reforms made up to now aim at increasing the services for insurance holders as well as removing defects in the social security system. In this context, various regulations have been made in the field of both health and retirement so that insurance holders can receive services at the shortest time. A number of implementations have been put into practice to facilitate insurance holders’ access to hospital services and the relevant procedure requiring a long wait has started to be made on internet.

The primary objective in a people-oriented system is to provide services at local levels. For this reason, the system where services are provided from center has been left and Social Security Centers have been built in many districts with a view to enable insurance holders at local levels to receive services easily.